For roughly 200 years, Santa has been retaining seasonal help at his Arctic Circle workshop. His undersized non-union workers toil in an icy land that sits beyond the jurisdiction of U.S. employment laws, a wise move by Mr. Claus and his attorneys.

For roughly 200 years, Santa has been retaining seasonal help at his Arctic Circle workshop. His undersized non-union workers toil in an icy land that sits beyond the jurisdiction of U.S. employment laws, a wise move by Mr. Claus and his attorneys.

While children around the world ask silly questions like, Can I visit the elves? and What do elves eat? and How do they work so fast?, this blog asks the serious question that all adult businesspeople want to know: Are elves employees or independent contractors?

Spoiler alert for the children: The answers are No, Caribou, and Amphetamines.

The adult question takes some analysis. Let’s peek behind the wintry curtain.

Remember when you used to go to the video store to rent VHS tapes and there was that little sticker on the tape cheerfully reminding you to “Be kind! Rewind!” I know, half of you have no idea what I am talking about, but there used to be these things for watching movies before Netflix — no, not DVDs, before that — no, no, not cave drawings, after that.

Remember when you used to go to the video store to rent VHS tapes and there was that little sticker on the tape cheerfully reminding you to “Be kind! Rewind!” I know, half of you have no idea what I am talking about, but there used to be these things for watching movies before Netflix — no, not DVDs, before that — no, no, not cave drawings, after that. I am often asked for a sample Independent Contractor Agreement. I do a lot of work in this area, so I should have plenty, right? Well, sure, I have drafted dozens, but they won’t do you much good.

I am often asked for a sample Independent Contractor Agreement. I do a lot of work in this area, so I should have plenty, right? Well, sure, I have drafted dozens, but they won’t do you much good.

Companies in distress sometimes retain management consultants to try to turn them around. Sometimes the plan works, sometimes not. When the turnaround effort fails and the company shuts down, can the management company be held liable as a joint employer?

Companies in distress sometimes retain management consultants to try to turn them around. Sometimes the plan works, sometimes not. When the turnaround effort fails and the company shuts down, can the management company be held liable as a joint employer? A federal Court of Appeals has

A federal Court of Appeals has  On Monday,

On Monday,  Congress may finally provide some clarity in determining who is a joint employer. In legislation introduced last week, the House proposed a bill that would rewrite the definition of “joint employer” under federal labor law (National Labor Relations Act) and federal wage and hour law (Fair Labor Standards Act).

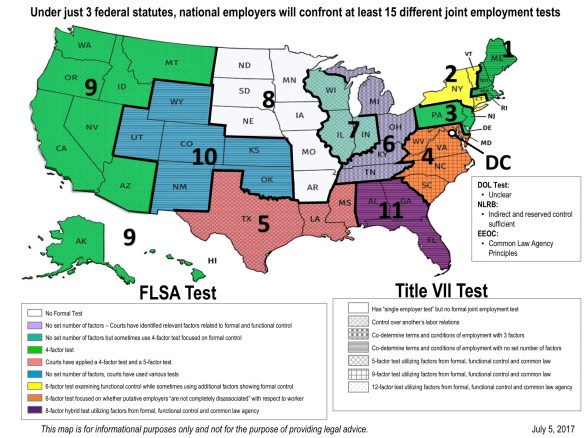

Congress may finally provide some clarity in determining who is a joint employer. In legislation introduced last week, the House proposed a bill that would rewrite the definition of “joint employer” under federal labor law (National Labor Relations Act) and federal wage and hour law (Fair Labor Standards Act). The tests for determining whether a business is a joint employer vary, depending on which law applies. That means there are different tests under federal labor law, wage and hour law, and employee benefits law, to name a few. There are also different tests under different states’ laws.

The tests for determining whether a business is a joint employer vary, depending on which law applies. That means there are different tests under federal labor law, wage and hour law, and employee benefits law, to name a few. There are also different tests under different states’ laws.