A legal battle in Seattle (“The Battle of Seattle!”) may soon determine whether independent contractor drivers can form unions. In 2015, the city passed a law allowing Uber and Lyft drivers to organize. The mayor allowed the law to go into effect but didn’t sign it because he was concerned it would spawn expensive litigation. He was right.

A legal battle in Seattle (“The Battle of Seattle!”) may soon determine whether independent contractor drivers can form unions. In 2015, the city passed a law allowing Uber and Lyft drivers to organize. The mayor allowed the law to go into effect but didn’t sign it because he was concerned it would spawn expensive litigation. He was right.

This month, a federal judge handed the City a victory, dismissing a lawsuit by the U.S. Chamber of Commerce which had argued that the ordinance was illegal. The decision is certainly not the last word on the subject, since the Chamber will appeal and there is a companion lawsuit still pending anyway.

The issues go beyond the basic question of whether independent contractors can form unions.

Generally, they cannot. Independent contractors are separate businesses. Antitrust law Continue reading

Trump and Sessions wants to prosecute the leakers. As we’ve seen before, stopping leaks can become a Presidential obsession. In Nixon’s White House, the Plumbers were tasked with stopping leaks of classified information, such as the Pentagon Papers. Through the Committee to Re-Elect the President (fittingly,

Trump and Sessions wants to prosecute the leakers. As we’ve seen before, stopping leaks can become a Presidential obsession. In Nixon’s White House, the Plumbers were tasked with stopping leaks of classified information, such as the Pentagon Papers. Through the Committee to Re-Elect the President (fittingly,  Congress may finally provide some clarity in determining who is a joint employer. In legislation introduced last week, the House proposed a bill that would rewrite the definition of “joint employer” under federal labor law (National Labor Relations Act) and federal wage and hour law (Fair Labor Standards Act).

Congress may finally provide some clarity in determining who is a joint employer. In legislation introduced last week, the House proposed a bill that would rewrite the definition of “joint employer” under federal labor law (National Labor Relations Act) and federal wage and hour law (Fair Labor Standards Act).

If you retain freelancers in New York City, pay attention.

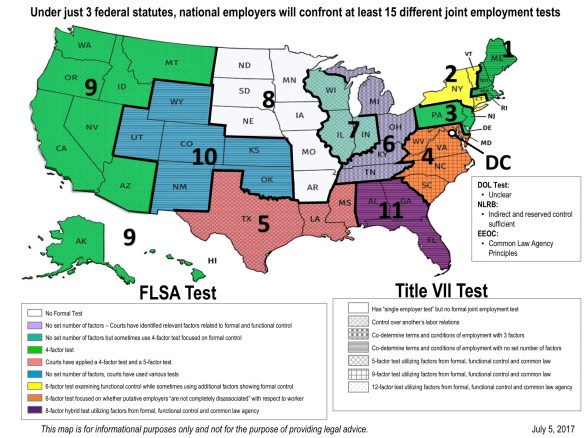

If you retain freelancers in New York City, pay attention. The tests for determining whether a business is a joint employer vary, depending on which law applies. That means there are different tests under federal labor law, wage and hour law, and employee benefits law, to name a few. There are also different tests under different states’ laws.

The tests for determining whether a business is a joint employer vary, depending on which law applies. That means there are different tests under federal labor law, wage and hour law, and employee benefits law, to name a few. There are also different tests under different states’ laws.

When I was an undergrad at Michigan, any time I would drive to the airport or to Tiger Stadium, I’d see billboards for Deja Vu, a strip club with (apparently) lots of locations. I never visited (not into that sort of thing, thanks for asking), and I never thought much of it. I certainly did not expect to be writing about Deja Vu and independent contractor misclassification 25 years later. But here goes.

When I was an undergrad at Michigan, any time I would drive to the airport or to Tiger Stadium, I’d see billboards for Deja Vu, a strip club with (apparently) lots of locations. I never visited (not into that sort of thing, thanks for asking), and I never thought much of it. I certainly did not expect to be writing about Deja Vu and independent contractor misclassification 25 years later. But here goes.

In the Lynyrd Skynyrd song, “Gimme Three Steps,” we find our hero cutting a rug down at a place called The Jug with a girl named Linda Lou. This catchy song has nothing to do with labor law but does deal with someone who finds himself in a bad situation (shakin’ like a leaf on a tree!) and needs three steps to get out the back door.

In the Lynyrd Skynyrd song, “Gimme Three Steps,” we find our hero cutting a rug down at a place called The Jug with a girl named Linda Lou. This catchy song has nothing to do with labor law but does deal with someone who finds himself in a bad situation (shakin’ like a leaf on a tree!) and needs three steps to get out the back door.