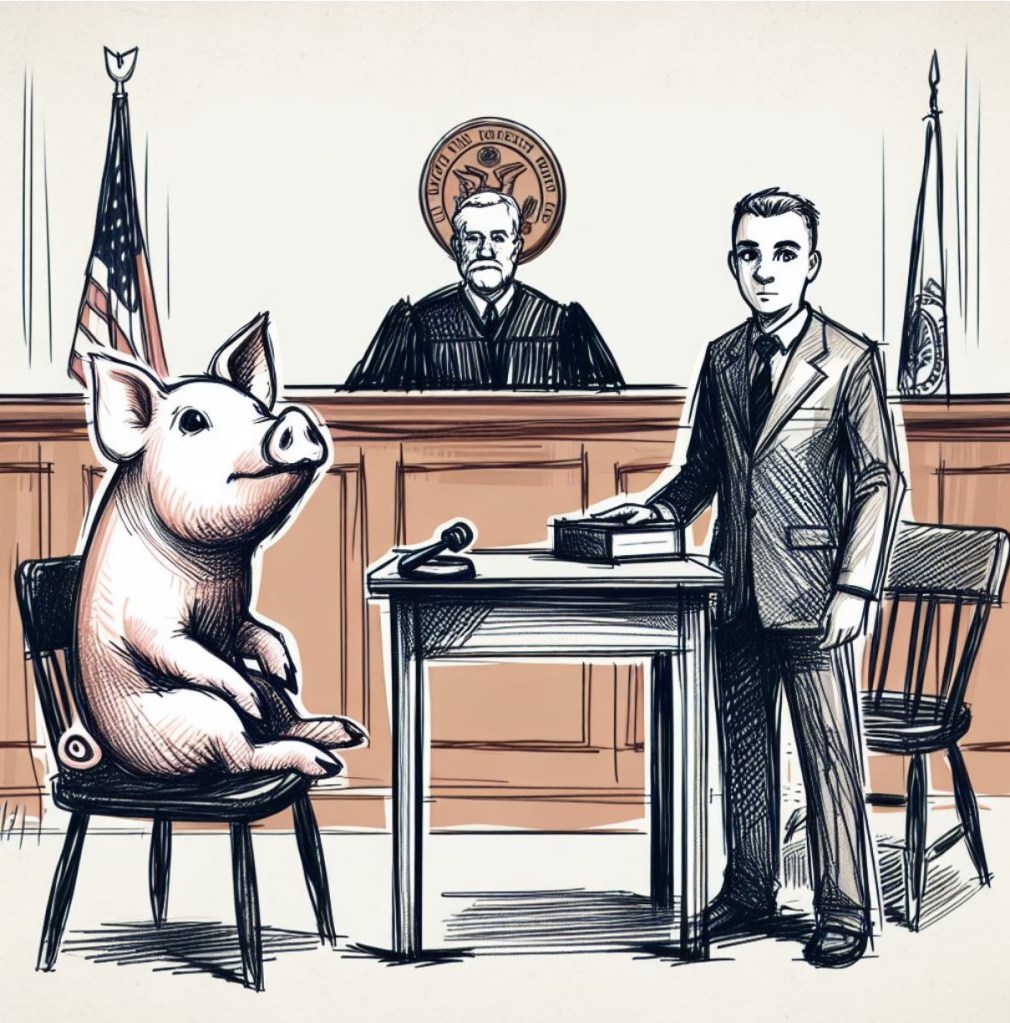

In medieval Europe, it was not uncommon to put animals on trial for various crimes. In France, Italy, Switzerland, and elsewhere, courts tried pigs, dogs, rats, grasshoppers, and snails for crimes against people, property, and God.

Examples include cases brought against vermin who dared to ransack stores of grain and prosecutions for pigs having maimed or killed people.

There’s a whole book about the practice, Chronological List of the Prosecution of Animals from the Ninth to the Twentieth Century, by E.P. Evans. I typed the name of the book in the search bar at Amazon. Apparently it is not available, and the site instead recommended that I purchase a DVD of Ransom, starring Mel Gibson. (?)

No, thank you.

I also say no, thank you to New Jersey Department of Labor and Workforce Development (NJ DLWD), which has proposed new independent contractor classification regulations.

The regulations would re-interpret NJ’s ABC Test in a way that would make it much harder to maintain IC status. The regulations would apply to the NJ Wage Payment Law, the Unemployment Compensation Law, and the Earned Sick Leave Law.

For years New Jersey has used an ABC Test, but with the standard version of part B, unlike California and Massachusetts, which have a strict version of part B.

To satisfy a standard ABC Test, like in NJ, the party engaging the contractor must prove (all three):

- The individual has been and will continue to be free from control or direction over the performance of work performed, both under contract of service and in fact; and

- The work is either outside the usual course of the business for which such service is performed, or the work is performed outside of all the places of business of the enterprise for which such service is performed; and

- The individual is customarily engaged in an independently established trade, occupation, profession or business.

The regulations would largely re-interpret part B to make it more like the strict version, which can be met only if the work is performed “outside the course of the business for which such service is performed.”

The regulation would essentially eviscerate the second option — that the work is performed outside of all the places of business of the enterprise for which such service is performed — and make it nearly impossible to satisfy this alternative.

For example, under the regulations, the retaining party’s “place of business” could include any place where the work is typically performed, even customer’s homes.

The regulations would also make parts A and C harder to meet. In part A, for example, the regulations would declare that control exerted to make sure a contractor follows the law is relevant control that can convert the worker to an employee. But control exerted to ensure compliance with a law is control imposed by the government, which passed the law, not by the company retaining the contractor. This re-imagining of part A would be inconsistent with a multitude of court decisions that have addressed this issue.

I say no, thank you, because the regulation is not consistent with New Jersey law and is not consistent with how other courts around the country have interpreted the ABC factors. The NJ DLWD is supposed to apply the law, not change it. The NJ DLWD is not a legislative body and is not a court.

Nonetheless, it seems like there’s a good chance this will pass.

A 60-day public comment period began with the publication of the proposed rule on May 5. Companies that will be impacted by the rule should consider submitting comments. Page 1 of the proposed regulations explains how.

Misclassification in New Jersey is serious business. The state has been aggressive about pursuing legal action against companies that systemically misclassify workers as ICs. (But so far, no cases against pigs, dogs, rats, grasshoppers or snails. I think.)

© 2025 Todd Lebowitz, posted on WhoIsMyEmployee.com, Exploring Issues of Independent Contractor Misclassification and Joint Employment. All rights reserved.