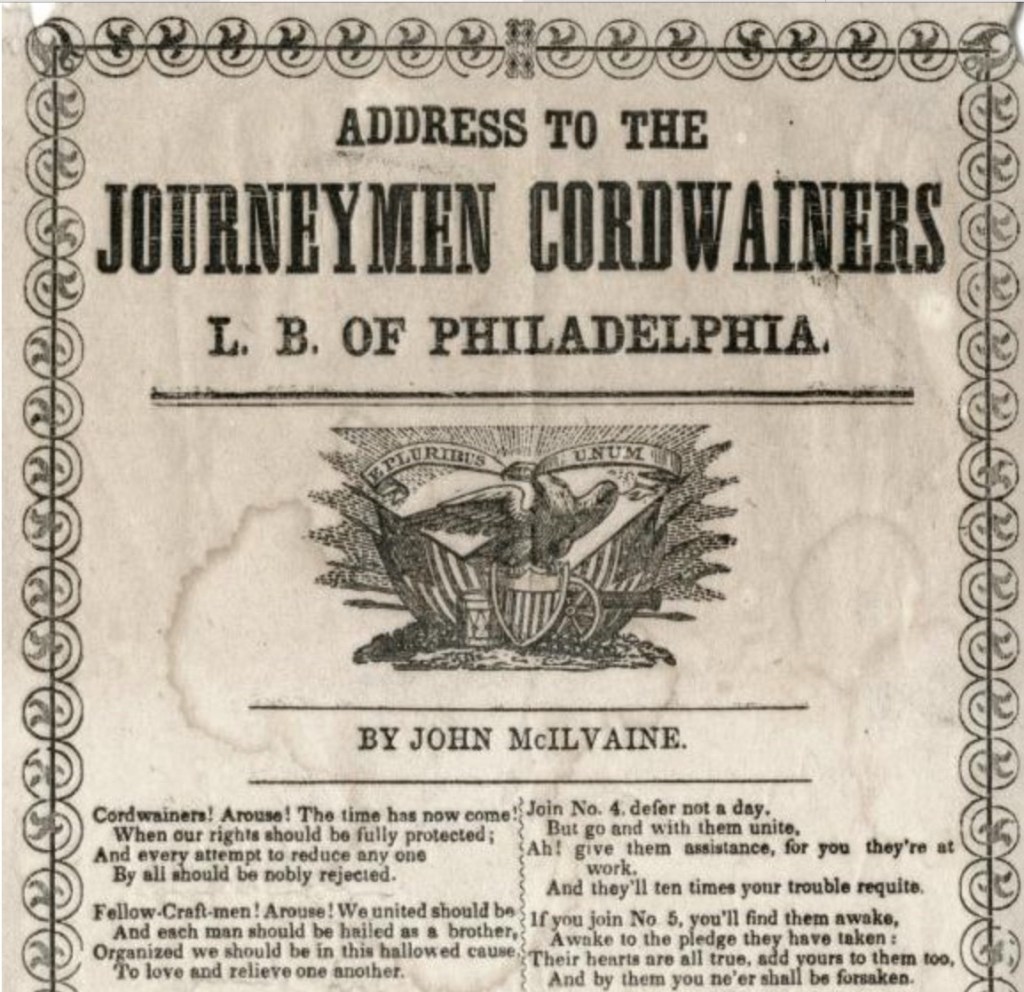

The first labor union in the United States was the the Federal Society of Journeymen Cordwainers, founded in 1794. What is a cordwainer? I had to look that up too, so I’ll save you the trouble.

It’s a shoemaker who makes new shoes from new leather, in contrast to a cobbler who repairs shoes. There aren’t a lot of cordwainers around anymore that I know of. Or maybe there are but they go by a name that sounds less weenie-ish.

There are, however, a lot of rideshare drivers. And the State of California thinks they would like to organize too.

But there’s a problem with that. The National Labor Relations Act protects employees, not contractors. When independent businesses band together to set prices, that’s called price fixing, and it presents all sorts of antitrust problems.

A new California law tries to get around these pesky legal problems.

The Transportation Network Company Drivers Labor Relations Act, AB 1340, allows rideshare drivers the right to collectively bargain, using a process to be overseen by the Public Employment Relations Board (PERB).

Rideshare companies must submit a list of eligible drivers every quarter, and these companies are required to negotiate in good faith with the yet-to-be-formed drivers’ group.

But they’re not “unions,” I suppose, even thought they walk like a union and quack like a union.

The statute is long and detailed. It has lots of procedures.

In 1805, the cordwainers’ union was alleged to be a coercive and violent organization, allegations that arose after a cordwainer on strike threw a potato at a scab. The potato broke a window.

Let’s hope the whole rideshare law thingie goes more smoothly, and we’ll see how this actually works in practice. A possible bad omen: The statute says nothing about the unauthorized use of potatoes.

© 2026 Todd Lebowitz, posted on WhoIsMyEmployee.com, Exploring Issues of Independent Contractor Misclassification and Joint Employment. All rights reserved.